Your super is there to fund your retirement. And the best time to retire is when you’re ready. Generally, however, you’re only allowed to access your super once you’ve reached a certain age. But in some cases, you may be able to withdraw your super early.

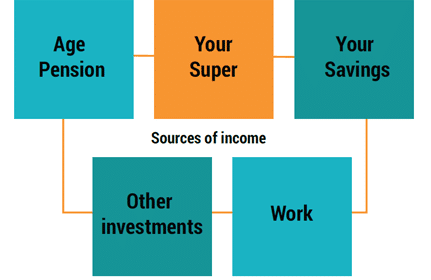

Your retirement income. Where will it come from?

While the money you have saved up in your super account will be an important source of your retirement income, you may also have income from investments or savings you have made outside your super (such as shares, property etc), the age pension, plus income from work you may decide to do in retirement.

You can leave your super where it is if you prefer.

Just because you’re eligible to open an Australian Food Super Pension account doesn’t mean you have to. You can leave all or part of your super where it is which means it remains invested for you and you get to maintain your insurance cover that’s attached to your membership. You can also keep making contributions to grow your super, but remember, contributions will continue to be taxed at the regular rate of 15%.

Want some tips on growing your super?

You’re in control of your super investments.

Australian Food Super gives members the opportunity to invest their super in one or more of our eight investment options (MySuper is not available to Pension members). This allows members to choose where their super is invested based on the return they’re after and the investment risk they are comfortable with.

What about the Government Age Pension?

The Government Age Pension can work to compliment your income if you’re eligible. Many Australians over 65 are eligible for at least a part Government Pension, so why not you*?

*Australian Institute of Health and Welfare, March 2021 – Age Pension figures – https://www.aihw.gov.au/reports/australias-welfare/age-pension

To be eligible, you need to reach a certain age.

| If you were born… | Your pension age is … |

| 1 July 1952 to 31 December 1953 | 65 years and 6 months |

| 1 January 1954 to 30 June 1955 | 66 years |

| 1 July 1955 to 31 December 1956 | 66 years and 6 months |

| 1 January 1957 onwards | 67 years |

The Age Pension age is rising because people are living longer in retirement. The Government is seeking to encourage people to build larger super balances so that their retirement savings will last longer.

Also, to be eligible, you need to have been an Australian resident for at least 10 years and you will need to pass an income and assets test. You can find out more about the income and assets test here.

You can find out more and apply for the Age Pension at Services Australia.

Do you have any questions?

If you have any questions, or you need assistance with any aspect of your Australian Food Super membership, just call the Member Hotline on 1800 808 614. Australian Food Super has engaged LinkAdvice to provide financial planning advice to our members. Simple advice can be obtained over the phone at no cost, or you can engage one of our advisors to help you work through more complex financial matters to help you reach your retirement goals.